Is a pet right for you? The personal finance perspective

- Jeff Hulett

- Oct 7, 2023

- 8 min read

Updated: Oct 9, 2023

We explore a holistic view of pet ownership. We consider the criteria or "what is important to you" about your relationship with the pet. We provide a long-term financial framework to properly evaluate the pet's costs. To bring it all together, we suggest Definitive Choice, a smartphone decision tool to implement the best pet decision.

About the author: Jeff Hulett is a career banker, data scientist, behavioral economist, and choice architect. Jeff has held banking and consulting leadership roles at Wells Fargo, Citibank, KPMG, and IBM. Today, Jeff is an executive with the Definitive Companies. He teaches personal finance at James Madison University and provides personal finance seminars. Check out his new book -- Making Choices, Making Money: Your Guide to Making Confident Financial Decisions -- at jeffhulett.com.

A Pet Perspective

In 2023, according to a Forbes Magazine article, there are about 87 million pet owners in the U.S. According to the ASPCA, the average pet owner spends nearly $1,400 annually on their furry pal. Thus, the total estimated annual cost of pet care is a whopping $122 Billion.

To start... essential to evaluating your pet decision is to understand your core motivation. In this case, the question is - "What is important to you about owning a pet?"

Evaluating pet owner benefits:

The essential pet criterion weighs the degree to which your and your family's emotional support are provided for by the pet.

According to Psychology Today, the essential reason people buy pets is because of the emotional support provided by their pets. The summary reasons are:

Pets attend potently to our brain's social circuitry.

Pets are pure. The pets' innocence is inspiring.

Pets only know and breathe connection.

In short, pets provide their owners emotional support in exchange for the pet being cared for by the owner.

Besides the psychological benefit, according to the VCA Animal Hospitals additional pet ownership criteria are:

1. Home environment (size):

The size of your home and yard, as well as your lifestyle, will play a significant role in determining which type of pet is right for you. For example, if you live in a small apartment, a large dog may not be the best choice.

2. Temperament:

The size and temperament of the animal should be compatible with your family’s lifestyle and needs. For example, if you have young children, you may want to choose a breed that is known for being gentle and patient.

3. Training and exercise needs:

Different pets have different training and exercise requirements. It’s essential to choose an animal that you can commit to training and exercising regularly.

4. Physical characteristics:

The physical characteristics of the animal should also be taken into account when selecting a pet. For example, if you have allergies, you may want to choose a breed that is hypoallergenic.

5. Lifespan:

It’s important to consider the lifespan of the animal when selecting a pet. Some pets, such as birds and reptiles, can live for decades.

6. Compatibility with other pets:

Other than pet benefits, prospective pet owners need to consider pet costs.

Initial and recurring costs:

Before choosing a pet, it’s essential to consider the financial commitment involved in pet ownership. This includes the cost of purchasing or adopting a pet, as well as ongoing expenses such as food, veterinary care, and grooming.

The connection to personal finance

In the context of personal finance, our "payment hierarchy" is an essential consideration when thinking about pets or other long-term financial commitments. A pet is like a fixed expense - such as a car loan, a mortgage, or other contractual debts. In my book, we discuss the need to "pay yourself first" and to avoid a well-intended expense devolving into "sludge." [i] In the context of the pet, the challenge is to properly categorize the animal as:

an investment,

a need-based expense,

or a want.

Getting the payment hierarchy correct and operationalized is essential to long-term personal finance success. Also, implementation enablers called "commitment devices" help ensure your payment hierarchy compliance.

Depending on where the pet falls, will drive the decision process and long-term outcomes. Next, we discuss the challenge of categorizing the pet's utility and then the financial implications of the pet acquisition. Also, because of the pet's nature, the pet will generally be prioritized at the top of the payment hierarchy AFTER THE PURCHASE. As such, getting this decision correct PRIOR TO THE PURCHASE is important as the pet decision is challenging to unwind.

The challenge is forecasting your utility over the likely expense time period. Let's assume a pet is a twelve-year commitment. Are the emotional benefits you and your family will receive worth the long-term costs? Let's face it, a fluffy puppy is as cute as a button. Next are some utility-clarifying questions:

Can you imagine that puppy as a full-grown dog?

What about your family? As they grow and change, are they likely to achieve the same benefits they receive today?

What is the benefit of the pet's emotional support to you and your family? Are there alternatives for that emotional support?

Are you committed to paying the long-term costs (money and time) to care for the pet?

Finally, how are those benefits prioritized relative to the funding substitutes? - like providing more resources for your retirement or other long-term priorities?

While forecasting our utility is challenging, forecasting the cost impact is achievable with a simple model. We know average pet costs are $1,400 per year. We also know the average age of a dog is 12 years. Let's say you acquire a pet in your early-to-mid 20s. In this example, we will assume you will keep the pet for its full average life. Also, we will assume some people will like pet ownership so much, that they will buy a second pet for an additional 12 years in the mid-to-late 30s. So we have 2 scenarios: a "1 Dog" for 12 years scenario and a "2 Dog" for 24 years scenario.

This graph shows the opportunity cost of diverting the pet ownership costs from retirement savings. The point is to put a hard value number on the pet ownership trade. Whether you use these resources to solve world hunger, your own retirement, or pet ownership is left up to you!

The assumptions for our simple model are that the $1,400 / year cash flows are invested in investment funds receiving an annual return of 10% over the pet owner's life, based on the two 12 or 24-year pet ownership scenarios. Retirement is assumed at 65 years old. Thus, in the 2 dog scenarios, the opportunity cost of pet ownership is:

So, in round numbers, the lifetime cost of a pet is about $1 million. To be clear, this does NOT include the indirect costs of your time to care for the pet. The modeled costs are food, medical care, and other direct costs. This should help you make the tradeoff decisions for your own utility and benefits.

An emotional support alternative

If emotional support is the primary criterion for a pet, then a reasonable question is:

"Are there less expensive emotional support substitutes?

According to Verified Market Research, an industry market research company, global online therapy services are projected to grow from a $2.6 Billion market in 2021 to an $8.3 Billion market in 2030. Clearly, pet-alternative emotional support is growing. The remaining open question is whether online therapy is a pet emotional support substitute. The benefit of online therapy, compared to pets, is that online therapy only lasts as long as emotional support is needed. Generally, pets are kept for their entire lives, regardless of the degree to which the pet provides emotional support over their life. Let's say that the $8.3 Billion market projection by 2030 is a necessary amount to provide Americans needed emotional support. That still leaves 93% of the resources available to be used to address starvation and undernourishment. [ii]

Is the $1 million pet ownership long-term opportunity cost worth it?

Is the $1 million worth reducing your own optionality for retirement or other long-term goals?

Is it worth buying a pet instead of getting emotional support from therapists and still having a significant portion of the $1 million for other long-term goals?

It is up to you!

Resources

Definitive Choice is an app decision solution to help you understand your self-interests and actions on almost all life decisions. The app can help you and your family buy a pet or consider other alternatives.

It provides a straightforward user experience. The number-crunching occurs in the background by time-tested decision science algorithms. It uses a proprietary "Decision 6(tm)" approach that organizes the preference criteria (what is important to you?) and alternatives (what are the choices?) in a series of bite-size ranking decisions. Since it is on your smartphone, you can use it while you are curating data to support the decision. It is like having a decision expert in your pocket. The results dashboard provides a rank-ordered list of recommended "best choices," tailored to your preferences.

Also, Definitive Choice comes pre-loaded with many decision templates. You will want to customize your own preferences (aka criteria) and alternatives, but the preloaded templates provide a nice starting point.

Using decision process solutions enables DECISION A-C-T:

Accelerated: faster, less costly decisions. It enables a nimble decision environment.

Confidence-inspired: process causes people to be more confident in the decision, increasing buy-in, and decision up-take.

Transparency-enabled: reporting, documentation, and charts to help communicate the decision.

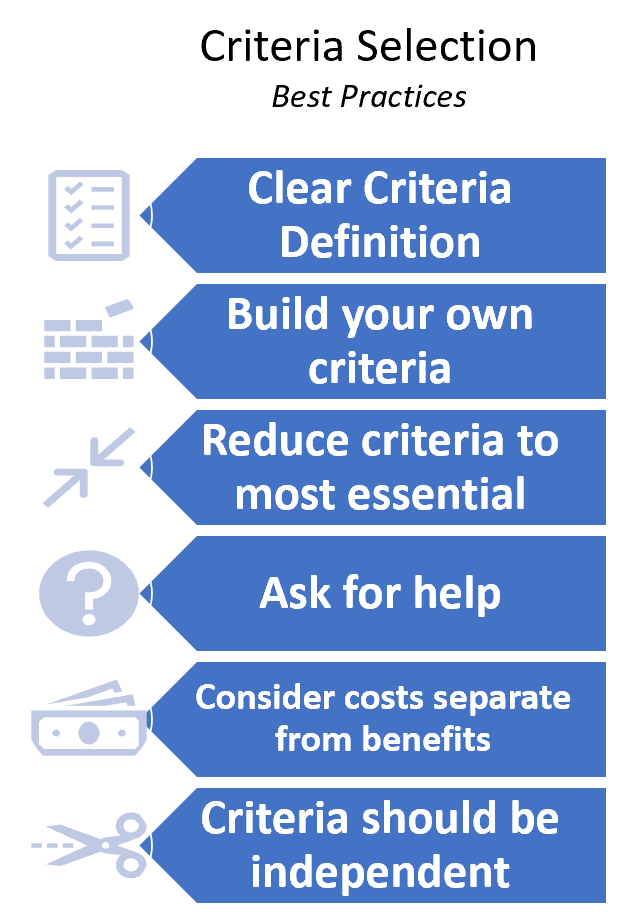

Best Practices

Clear Criteria Definition: Clearly define each criterion for your ‘what is important to you” utility model. These are the benefits you receive from the acquisition of the objective. In this example, the objective is a pet. A ChatGPT question like “What are the top criteria for purchasing a __________?” is a great way to confirm your criteria definitions. Each criterion should have a series of dot points to clarify its definition.

Build your own criteria: Definitive Choice provides typical criteria as a starting point. We encourage you to develop your own and add to the list. The same ChatGPT question is helpful for confirming your criteria.

Reduce criteria to most essential: Generally, you do not want more than 5 criteria. So, subtract the criteria you know are of no or little value to you. For example, if you do not already have a pet and do not anticipate having multiple pets, then the "Compatibility with other pets" criterion may be deleted.

Ask for help: Definitive Choice allows you to invite others to participate in the decision by sharing their own utility model. This is especially helpful for those who are first-time buyers. The invited person should be a “Conscience Person” and someone who has experience with the purchase. A conscience person is generally someone you do not want to disappoint… like a parent or a respected friend.

Consider costs separate from benefits: You can include cost as benefit criteria, but you run the risk of double counting costs. We recommend separating cost from benefits and considering the tradeoffs between the costs and benefits as separate dimensions.

Criteria should be independent: A natural tendency is for people to mentally combine separate criteria categories. It is essential to BOTH define each criterion definition AND to ensure each criterion is independent of the others. This can be a little tricky. For example, for a pet, you want to consider a pet with the appropriate size to fit the environment and the size and temperament to fit your family's needs. In this case, size can be independent as long as it is considered separately from the environment and the family members' needs. However, if those 2 criteria are always the same, then you should combine the criteria into a single criterion. For example, if you have an apartment requiring a small animal and you have young children that require a small animal, then combine these 2 criteria into a single “Size” criterion. Perfectly correlated criteria run the risk of double counting or overweighting.

Notes

[ii] Hulett, How we learn is how we discriminate, The Curiosity Vine, 2023

Comentários