Services for startups, entrepreneurs, and content creators

- Jeff Hulett

- Aug 26, 2024

- 9 min read

Updated: Jan 31

About Personal Finance Reimagined: PFR is an entrepreneur services organization. We help entrepreneurs stay focused on today's business growth and priorities. PFR helps the entrepreneur with other, less pressing but important needs, like back office, risk management, and strategy development.

Services for the entrepreneur

Our goal is to help you grow and be a successful innovator. PFR has incubated many companies with various levels of PFR investment. Beyond our own significant experience, we have a deep network of investors and service providers at the ready to provide services as needed. Our sweet spot is helping early-stage startups. Often those startups are family-funded, early stage pre-funding, but also be in search of additional seed funding.

Think of PFR as your part-time CFO, overseeing many back-office operations. Outside of your core business, PFR helps you create and execute a long-term financial plan to help your business, you, and your family.

We help you implement the Investment Barbell Strategy, a tried and true approach to driving long-term wealth. This is the same approach taught in University Personal Finance classes.

We offer flexible payment terms, aligning with the entrepreneur's liquidity timing and equity availability.

Let us know how we can help.

For a case study, please see our investment fund developed for The Hulett Brothers:

The rest of the article provides the Capital Formation path to scale your business.

The capital development process

The move toward the latest innovation, like many massive transformations, grows in fits and starts. Capital flows to many innovators, some innovations work and many do not. In fact, investment capital provider companies’ batting average for successful portfolio companies is well below .500. The investment capital model is to invest in many high-potential innovation companies, scale the ones that work, and quickly sunset those that do not. It is a statistical game that works because the upside of the winners more than pays for the cost of the losers. We will discuss an ecosystem of investment capital providers, including Venture Capital, Private Equity, and Public Equity Markets.

Capital Development Model:

Startup companies have 3 capital phases characterizing their growth. As we show in the following section, each capital phase is associated with a type of capital provider. These capital providers specialize in the capital needs of the particular phase.

In the next section, each of these phases is more fully described, along with the typical capital providers for each phase. At the end of the next section is an Investment Capital Ecosystem summary graphic.

Most companies either do not make it to Phase 3 or must significantly adapt their business models to make it to Phase 3. Successful innovators must adapt as the preferences of the fickle consumer are revealed. There is a big difference between having a good idea or invention and the hard work, tenacity, and risk-taking required to innovate, scale, and adapt to consumer preferences. Thomas Edison, the innovator who brought the world the light bulb, comments on the hard work of innovation [vii]:

“Genius is two percent inspiration; ninety-eight percent hard work.”

The three platform company phases

Phase 1 -- Good ideas and high-energy founders willing to take innovation risks to attract capital.

Phase 1 Investment Capital Provider: Friends & Family, Angel investors, Venture Capital

Phase 1 starts with a good idea. This is the early stage where only the most innovation-available customers try the new thing. The new thing usually fills a demand gap and/or provides efficiency well over existing providers. But getting people to try 'the new thing' is always a challenge because people are naturally risk averse.

To support the founder’s innovation, capital flows in via early-stage funding and idea development support. At this point, the innovator may or may not have revenue demonstrating customer demand. Capital is attracted to a good idea, the quality of the founding team, and the early-stage demonstration of innovation demand. At this stage, the founders are VERY important because the capital providers know much testing and adaptation needs to occur to properly innovate. Also, the support of idea incubators is common early in the innovation process. Idea incubators help foster network effects. Feedback and input from credible sources are essential in the good idea phase. The mindset and abilities of the founder team are essential to success. It is often said Venture Capitalists invest more in founders’ adaptability than the business plans. [viii]

The legal environment does not see the new entrant as anything other than an entity that needs to follow existing rules. Because market economies like the U.S. generally provide ex-ante law, the rules are established in advance so the innovator can innovate given a known and reasonably stable rule set. This is very important. Varying and fickle ex-post laws as found in totalitarian countries make innovation almost impossible. We don't always like the laws, but at least we know what they are!

Existing rules MAY be more tolerant of smaller companies struggling to get started. For example, when AirBnB started, the municipal taxing authorities generally ignored hosts that allowed guests to stay with them for a couple of nights. This meant sales, lodging, and other municipal taxes were not enforced. AirBnB was small and committed to helping people get places to stay. Without AirBnB, their guest customers would pay more for traditional lodging, if it was available. It allowed hosts with excess capacity, like a bedroom in a house, to provide less expensive housing to those in need and potentially in locations with few alternatives. It was a win for all and generally below the radar screens of both taxing authorities and hotel chains. As we will discuss in later phases, the legal grace shown to smaller companies is likely peeled away as they successfully grow larger. As a fine point, there is an important difference between the knowledge of an ex-ante rule like taxation or consumer protection and whether or not the legal authority chooses to enforce the rule.

Another example of small company legal grace is in FinTechs and the CFPB. "FinTech" is a general name for smaller firms focused on financial industry innovation. The Consumer Financial Protection Bureau ("CFPB") is the U.S. regulator that enforces consumer financial protection laws on financial services companies. The CFPB was created by the Dodd-Frank Act as a result of the 2008-09 financial crisis. The number of regulations has dramatically increased since this time as well as the costs to those financial firms to implement regulations. The CFPB has an explicit minimum size of a regulated entity in its regulatory enforcement scope. This does NOT mean consumer protection laws do not apply to smaller FinTechs. It simply means the CFPB is less likely to enforce those laws until the FinTech gets larger. Thus, this keeps regulatory costs lower for smaller companies to encourage financial innovation.

At the end of Phase 1: Venture capital and related investment capital may be replaced by private equity capital providers. Phase 1 investors harvest their gains and fund another batch of high-potential companies seeking Phase 1 funding opportunities.

Phase 2 -- Growth stage when the platform business gets traction.

Phase 2 Investment Capital Provider: Private Equity and Investment Banks

Once the platform company finds some level of market acceptance and has found a path to profitable growth, it hits the accelerator. This means the new thing has been innovated, demand-tested, and fine-tuned to the point where demand has been confirmed and a path to scalable growth has been identified. There are still risks, but the uncertainty is giving way to more customer demand and a clearer path to profitability. It is an exciting time when the founders lead their platform companies from smaller to larger. Innovation is still important, but the innovation focus shifts from demand identification to scaleable growth.

The capital providers play an important networking role in connecting the high-growth, Phase 2 company with needed support services typical of a more mature business. These support services are technology providers, risk management, data science, accounting and finance, and others. The idea is to let the founder and the startup team focus on customer growth and take the less strategic but still important business activities off them. The capital providers also may become less patient. They may restrict capital to revenue-producing activities instead of testing additional innovations associated with Phase 1. It can create a natural tension between the start-up company culture and the capital owners. The founder may feel stuck in the middle.

At the end of Phase 2: Private Equity and related capital providers will often get bought out at the end of Phase 2. Phase 2 investors harvest their gains and fund another batch of companies transitioning from Phase 1 to Phase 2.

Phase 3 -- Public buy-out.

Phase 3 Investment Capital Provider: Public Equity markets

At this stage, the private capital providers are looking for an exit. This is after the platform company has grown significantly and the initial investment may be worth 10x or more. In the U.S., the public markets are generally SEC registrants selling their equity shares on the major stock markets. The public markets generally have different financial expectations. SEC registrants report profitability every 3 months. The public company incentives generally attract professional managers adept at driving quarterly income. Longer-term investment and innovation become more challenging. The incentives for short-term profits may create short-term thinking.

For example, that same, cuddly AirBnB company of yesterday is a behemoth public company today. The taxing authorities have caught up with the AirBnB platform. The competition with hoteliers and other traditional lodging companies is intense and the difference in prices has all but evaporated.

The Phase 3 behaviors are not always positive. For example, Airbnb plays the “hide the price game” by burying the final price behind a selection wall. The platform enables playing games with cleaning fees and other “junk fees” that make it challenging to compare prices. As a former consumer banker, this behavior feels patently inappropriate. If AirBnB were a mortgage company, they would be breaking several Truth In Lending laws. [ix]

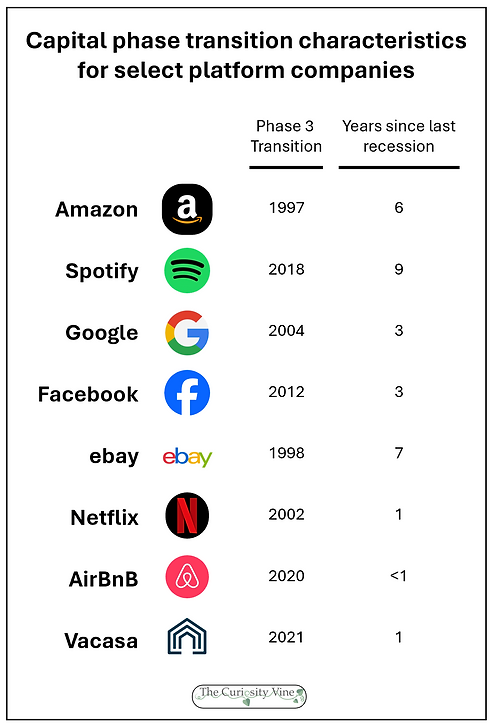

The next table describes the phase and phase transition characteristics of the platform companies assessed for this article. Vacasa and AirBnB are the youngest phase 3 platforms. Vacasa and AirBnB are also the only platform companies to transition to Phase 3 after the pandemic's beginning. Vacasa and AirBnb have the shortest Phase 3 transition following the prior economic downturn. This means the environment into which Vacasa and AirBnb phase transitioned was less stable compared to the other platforms. We will discuss Vacasa more in sections 6 and 7.

At the end of Phase 3: Phase 3 is the terminal point for the platform company's capitalization ‘happy path’: Other than continued growth as a public company, potential Phase 3 transition exits include merger, acquisition, spinoff, and bankruptcy.

The founders and innovation effect: The founders often get kicked to the curb in deference to public company managers. This is the definition of being a ‘serial entrepreneur.’ A founder builds something really cool that ultimately gets bought out in Phase 3. The founder then returns to Phase 1 to develop their next innovation. For many founder-innovators and their capital providers, successful innovation is more process-oriented than product-oriented. Innovators are more likely individuals who can successfully manage the innovation process. When predicting a founder's success, the founder's mindset and ability to manage the innovation process are generally weighted higher than the thing being innovated. A good innovator is more likely to adapt the thing being innovated as needed to enable success. There are exceptions to the 'serial entrepreneur' rule. Jeff Bezos is an example of a founder successfully making the Phase 3 transition.

Innovation is not always rewarded in Phase 3. The Phase 3 company’s focus on short-term earnings is not always a bad thing. This suggests market demand has voted with their feet and deemed the product or service as meeting their needs. The public markets and customers may wish the company to stay in its product or service swim lane. In effect, Phase 3 naturally defers to Phase 1 for innovation.

To be fair, some large companies do innovate. However, the innovation context for a Phase 3 platform is very different than a Phase 1 platform. The relatively rigid structure required to support the size of a Phase 3 company is the very structure that makes it challenging to innovate like a Phase 1 company. This rigidness also creates fragility and makes a Phase 3 company more susceptible to disruption. It is the degree of rigidity that enables the Schumpeterian creative disruption. The more rigid Phase 3 company creates the opportunity for a Phase 1 company to innovate. This rigidity creates demand gaps where insatiable consumer demand is not being met. Phase 1 companies seek to fill the gaps. Since the 1950s, the average age of companies has dropped from about 60 years to less than 20 years today. [x] This suggests that the phase-based creative destruction is only accelerating.

Capital formation and idea development

Notes

[vii] 1898 April, The Ladies’ Home Journal, The Anecdotal Side of Edison, Subsection: His Estimate of Genius, Start Page 7, Quote Page 8, Column 2, Curtis Publishing Company, Philadelphia. (ProQuest American Periodicals)

[viii] Fratto, 3 ways to measure your adaptability -- and how to improve it, TED Talk, 2019

[ix] The Truth in Lending Act (TILA), 15 U.S.C. 1601 et seq., was enacted on May 29, 1968, as title I of the Consumer Credit Protection Act (Pub. L. 90-321). The TILA, implemented by Regulation Z (12 CFR 1026), became effective July 1, 1969.

[x] Sheetz, Technology killing off corporate America: Average life span of companies under 20 years, CNBC, 2017

コメント