In the rapidly evolving financial landscape, auto lending has become an essential product in banking portfolios, requiring increasingly sophisticated tools for optimization. Agent-based modeling (ABM) is a simulation framework designed to model the actions and interactions of individual agents—whether they are consumers, businesses, or market entities—within a complex system. Each agent operates according to its unique preferences, goals, and constraints, allowing ABM to replicate real-world dynamics with remarkable precision. Unlike traditional models that rely on static averages, ABM provides a bottom-up view, capturing how micro-level decisions and behaviors collectively drive macro-level outcomes. This makes it an ideal tool for understanding markets like auto lending, where buyer preferences, dealership incentives, and financing options dynamically interact. For a deeper dive into how ABM has been applied in the auto lending context, refer to Jeff Hulett's article, "Banking on Insight: Lessons from Agent-Based Modeling in Auto Lending."

About the author: Jeff Hulett leads Personal Finance Reimagined, a decision-making and financial education platform. He teaches personal finance at James Madison University and provides personal finance seminars. Check out his book -- Making Choices, Making Money: Your Guide to Making Confident Financial Decisions.

Jeff is a career banker, data scientist, behavioral economist, and choice architect. Jeff has held banking and consulting leadership roles at Wells Fargo, Citibank, KPMG, and IBM.

At the core of ABM is its ability to identify the utility for each synthetic customer agent—built on actual data from people actively engaged in the car-buying process. By simulating individual agents and their interactions within complex systems, ABM provides unparalleled insight into how real preferences and behaviors shape financial decisions, allowing banks to optimize loan offerings and manage risks more effectively. Agents in this context include borrowers, dealerships, and banks, each governed by distinct rules and preferences. ABM replicates real-world outcomes such as loan defaults, pricing sensitivities, and borrower behaviors under various economic conditions.

Next, we will discuss an innovative smartphone solution called Definitive Choice, which enables the anonymous recording of buyer preferences through app usage as they navigate their car purchase. This tool not only captures weighted preferences in real-time but also helps build robust utility functions for ABM simulations. Definitive Choice is envisioned as a powerful, scaleable resource for consumer auto finance companies, loan aggregators like Lending Tree, data aggregators like True Car, and car dealerships to assist auto customers in finding the best vehicle and financing option tailored to their needs. By bridging advanced decision science with practical applications, this methodology offers transformative potential for the auto lending ecosystem. Read on to see how this technology could redefine the future of auto lending.

To demonstrate this process, we apply a seven-step methodology inspired by a similar framework developed for the D.C. real estate market. These steps provide a structured approach for banks to refine their understanding of borrower behaviors and preferences, enabling them to design competitive products and manage risks effectively.

Step 1: Defining and Weighting Customer Preferences

The first step involves defining and weighing customer preferences for auto purchases and financing. Definitive Decision Technology applies the Analytic Hierarchy Process (AHP) developed by Thomas Saaty to conduct pairwise comparisons of preferences. In auto lending, the following criteria are typical examples, but they can be updated to reflect specific customer priorities:

Monthly payment affordability: Evaluating how critical it is for borrowers to fit loan payments into their monthly budgets.

Loan interest rate: Measuring sensitivity to the cost of borrowing.

Car features and performance: Capturing how vehicle functionality, reliability, and technology influence decisions.

Loan term length: Assessing borrowers’ preferences for shorter versus longer repayment periods.

Safety ratings: Factoring in the importance of crash-test scores and safety features.

Convenience: Capturing borrower preferences for streamlined financing at the dealership versus securing pre-approved loans.

By capturing preference weights, banks can create detailed profiles of borrower behaviors. For example, some customers might prioritize monthly payment affordability over a low interest rate, while others may focus on the safety features of a vehicle. The flexibility to update these criteria ensures that the model remains relevant to diverse and evolving customer needs.

See Appendix 1 for an introduction to the AHP mathematics and process.

Step 2: Building Utility Functions

With preferences defined and weighted, utility functions are constructed to represent the decision-making process of each customer agent. A utility function might take the form:

U = w1 × Affordability + w2 × InterestRate + w3 × CarFeatures + w4 × DealerIncentives + w5 × LoanTerm + w6 × Convenience

Here, w1,w2,…,w6 are weights derived from the AHP process, reflecting each criterion's importance to the agent. The weights sum to 1.

These functions allow agents to rank financing options and car models based on their personal preferences, providing banks with insights into how customers might react to different loan terms or dealership promotions.

For example, a utility function can show that a borrower prioritizes a lower monthly payment over a shorter loan term, suggesting they might choose a dealership offering extended financing plans even at slightly higher interest rates. This approach shows how each customer maximizes their utility from the car purchase.

See appendix 2 for clarification of utility maximization and rationality.

Step 3: Constructing Aggregate Utility Curves

The next step aggregates individual utility functions to create demand curves for the auto lending market. These curves reveal insights into pricing elasticity, market segmentation, and borrower sensitivity to interest rate changes. By segmenting agents based on characteristics like income, car preferences, or credit scores, banks can identify underserved market niches and tailor loan products accordingly.

For instance, aggregating demand curves might show that borrowers in suburban areas are more sensitive to dealer incentives, while urban borrowers prioritize loan term flexibility. These insights enable banks to refine their marketing and pricing strategies.

By design, utility curves are not required to be aggregated. This recognizes each person's "Diverse Rationality." Individuals are likely to have a unique car-buying perspective and that perspective may change over time.

Step 4: Incorporating Dealership Perspectives

Dealerships play a critical intermediary role in the auto lending process. Incorporating their preferences into the ABM enhances its realism. For example, dealerships may prioritize lenders offering higher dealer reserve payments, competitive buy rates, or streamlined loan processing.

By integrating dealer agents into the model, banks can simulate the impact of pricing decisions on dealership relationships. For instance, raising rates for low-performing dealers might lead to reduced loan volume from those dealers, negatively impacting the bank’s profitability. This cascading effect highlights the importance of calibrating pricing strategies to maintain strong dealer partnerships.

Step 5: Accounting for Cognitive Biases

Cognitive biases significantly influence borrower decisions in auto lending. For example:

Loss aversion: Borrowers may prioritize trade-in values to minimize perceived losses on their current vehicle.

Anchoring: Borrowers might anchor their decisions on initial quotes provided by dealerships, even when better options are available.

Overconfidence: Borrowers may overestimate their ability to manage higher monthly payments.

Definitive's approach accounts for these biases by incorporating them into the preference-weighting process, ensuring the ABM reflects realistic borrower behaviors. Crucially, the technology identifies the actual preferences of customers, acknowledging the existence of cognitive biases.

Step 6: Generating Synthetic Customer Agents

To simulate large-scale market dynamics, the model generates synthetic customer agents based on historical data and preference weights. These agents represent diverse demographic groups, such as high-income buyers seeking luxury vehicles or budget-conscious customers prioritizing low monthly payments. By replicating these preferences, synthetic agents enable the ABM to simulate broad market trends and segment-specific behaviors.

Step 7: Enabling Dynamic Interactions

ABM excels in capturing the dynamic interactions between borrowers, dealerships, and banks. For example:

Borrowers might adjust their preferences based on dealer promotions or interest rate changes.

Dealers may modify their incentives in response to borrower demand.

Banks might recalibrate pricing policies based on observed loan performance.

These interactions produce emergent market behaviors, such as shifts in borrower preferences or changes in dealership profitability. By simulating these dynamics, the ABM provides a comprehensive view of the auto lending ecosystem.

Conclusion: Transforming Auto Lending with Preference-Weighted ABM

By combining real-world data and behavioral insights, ABM empowers financial institutions to simulate individual decision-making processes and their interactions within complex systems. At its core, ABM identifies the unique utility of each synthetic customer agent, providing an unparalleled view of how micro-level preferences shape macro-level outcomes. Tools like Definitive Choice further enhance this capability by capturing real-time buyer preferences, enabling the construction of robust utility functions that align with actual consumer behavior. This innovative approach is not only transformative for auto lending but also demonstrates how advanced decision science can bridge practical applications and cutting-edge simulation to redefine the future of financial services.

Appendix 1: AHP Simplified: Understanding Multi-Criteria Decision Making

The process begins with customers defining their decision criteria. While any criteria can be chosen, the six in the table below serve as examples. It is generally best to limit the number of criteria to six or fewer. Each criterion should be clearly defined and distinct from others to avoid overlap. For example, in this case, Affordability is treated separately from Interest Rate and Loan Term, even though these could overlap. In statistics, overlapping criteria—similar to correlated independent variables—is referred to as multicollinearity. Reducing overlap in criteria improves the results, similar to how statistical models perform better without multicollinearity. This concept is explored further in the article Overcoming the AI: Making the Best Decisions in Our Data-Abundant World.

Once criteria are defined, a pairwise comparison is performed to assign weights. This approach aligns with our evolutionary biology, which favors decision-making by comparing two items at a time—such as deciding whether to run from a lion or stay put! In human psychology -- this fast, pairwise process is called "heuristics." The AHP technique leverages this biological preference for heuristic accuracy and simplicity. Tools like the app Definitive Choice offer an elegant interface to streamline pairwise comparisons, making the process even more intuitive.

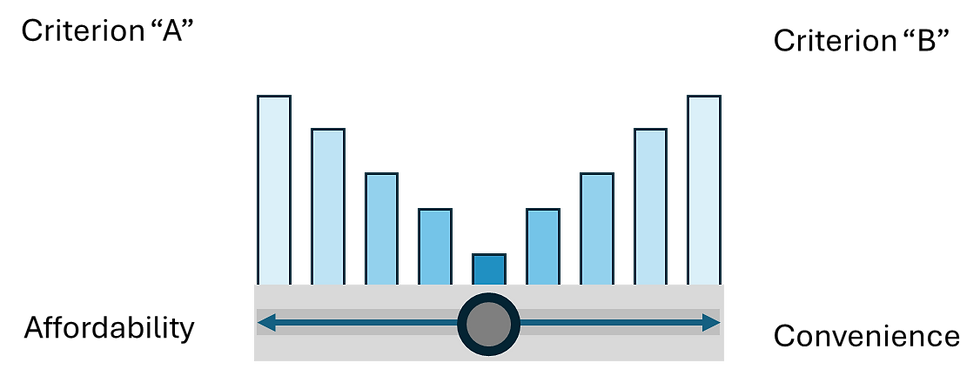

In this method, the decision-maker compares two criteria (e.g., A versus B) and assigns a relative importance score on a scale of 1 to 9. Imagine using a slider to express the strength of preference. This process requires the car buyer to make a tradeoff - for example - moving the slider more toward "Convenience" means the customer is willing to give up more "Affordability" benefit to achieve a higher "Convenience" benefit. The app simplifies this process further by efficiently guiding users through the workflow.

Next, matrix algebra is used to process the pairwise comparison data, resulting in the eigenvector. The eigenvector represents the utility weights of the criteria. For example, in this case, the car buyer values Convenience the highest, closely followed by Affordability, with the remaining criteria weighted lower. In AHP, the eigenvector is calculated as the principal eigenvector of the pairwise comparison matrix. This means identifying the vector that, when multiplied by the matrix, produces a scalar multiple of itself, with the scalar being the largest eigenvalue. This normalized eigenvector sums to 1, ensuring tradeoffs are accounted for within the fixed total utility of the decision, reflecting a world where resources are finite.

This process is essential because people are naturally poor at assigning multi-criteria weights with tradeoffs. They often either give equal weight to all criteria or focus heavily on one, ignoring the rest. The AHP-based pairwise workflow helps address these tendencies, producing more balanced and accurate results.

Finally, the eigenvalue (Lambda) provides a consistency check for the decision-maker’s judgments. It evaluates logical transitivity, such as: if A is preferred to B and B is preferred to C, then A should logically be preferred to C. People often struggle with transitive reasoning, but the eigenvalue measures how consistent or inconsistent their judgments are. Importantly, utility assessments do not require perfect consistency. Enforcing it could eliminate the natural cognitive biases that shape real-world decision-making. However, the eigenvalue can be useful when scaling tools like Definitive Choice for broader use. For example, extreme eigenvalues can help detect bad actors attempting to game the system with random inputs. Flags might include judgments that are overly logical or entirely random, indicating potential misuse.

Thanks to Klaus Goepel for providing the AHP tool.

Appendix 2: Clarifying Utility Maximization in the Context of Diverse Rationality

The concept of “maximizing utility” in Step 2 is not intended to imply the traditional economic assumption of a single, convergent rational outcome for all agents. Instead, this framework embraces the principle of diverse rationality, which acknowledges that rationality is personal, context-dependent, and shaped by bounded rationality—agents make decisions within the constraints of limited information, cognitive biases, and situational factors.

For instance, a car buyer may prioritize a car feature over a safety rating in one scenario but shift focus to safety because of changing family dynamics. These dynamic preferences reflect the real-world diversity in decision-making, and utility functions in the ABM approximate each agent’s unique rationality at a given moment.

Choice architecture tools like Definitive Choice play a critical role in capturing this diverse rationality across larger groups, enabling the modeling of preferences that reflect the complexity and adaptability of real-world decision-making at scale.

See: Hulett, J. (2024). Becoming Behavioral Economics: The Social Science Revolutionizing Decision-Making. The Curiosity Vine.

Resources for the Curious

From Jeff Hulett:

Hulett, J. (2023). Banking on Insight: Lessons from Agent-Based Modeling in Auto Lending. The Curiosity Vine.

Hulett, J. (2023). Becoming Behavioral Economics: The Social Science Revolutionizing Decision-Making. The Curiosity Vine.

Key References on Agent-Based Modeling:

Axtell, R., & Farmer, J. D. (2023). Agent-Based Modeling in Economics and Finance: Past, Present, and Future. Journal of Economic Literature.

Epstein, J. M., & Axtell, R. (1996). Growing Artificial Societies: Social Science from the Bottom Up. MIT Press.

Miller, J. H., & Page, S. E. (2007). Complex Adaptive Systems: An Introduction to Computational Models of Social Life. Princeton University Press.

On Preference-Weighted Decision Science and Behavioral Economics:

Goepel, Klaus D. Business Performance Management Singapore (BPMSG). BPMSG, https://bpmsg.com. Accessed [insert access date].

Saaty, T. L. (1980). The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation. McGraw-Hill.

Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. Yale University Press.

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–291.

On Auto Lending and Consumer Behavior:

Chatterjee, P., & Heath, T. B. (1996). Conflict and Loss Aversion in Multiattribute Choice: The Effects of Trade-Off Size and Reference Dependence on Decision Difficulty. Advances in Consumer Research, 23, 103–108.

TrueCar Research Center. (2022). Consumer Preferences in Auto Buying and Financing: A Data-Driven Analysis. TrueCar White Paper.

Love the AHP application!